The artificial intelligence (AI) software market has experienced tremendous growth since Omdia first started tracking it in 2016.

Back then, the AI software market model covered approximately 100 use cases by industry lines.

Today, Omdia’s AI market model forecasts 352 use cases by industry slices, and more are identified and added to each six-month update.

The market is beginning to mature. It is shifting from trials or assessments to full-scale implementation as end users find AI software can help cut costs and generate new revenue streams. Yet, AI software remains a relatively small portion of overall software sales, with varying acceptance across industries. Significant opportunity lies ahead for AI software market penetration, but its growth rate will slow as the market continues to mature.

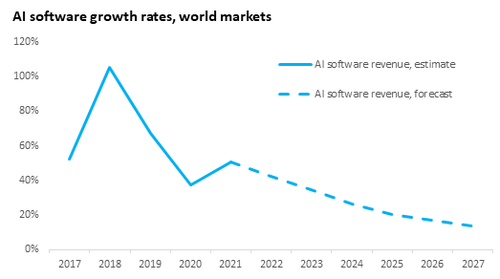

As a newly introduced technology, AI growth was initially rapid. In 2018, AI software application revenue doubled (105%) to surpass $10 billion while growth decelerated to 67% in 2019.

COVID-19 had a further impact on the market in 2020 when AI growth was “only” 37% and the market reached $24 billion.

AI software revenue will rebound by 51% in 2021 and by 2027 will reach more than five times its 2020 value ($138 billion), a 29% CAGR from 2020, according to Omdia’s new Artificial Intelligence Software Market Forecasts.

Figure 1: AI software revenue forecast, world markets, annual growth rates: 2017–27, Omdia

What drives AI’s high growth rates?

AI software, like other emerging technologies historically (think smartphones), simply does things better than the legacy counterparts it is replacing.

It enables analytics of large datasets (more quickly and more meaningfully), it cuts costs through automation, it drives revenue through customer personalization and targeting, and it creates things (reports, apps, interfaces, or even digital worlds) not previously possible without it.

Market factors specifically driving AI growth in 2021 and beyond include:

- Automation and optimization of processes: Organizations are automating a greater range of business processes and customer services to develop resiliency, efficiency and flexibility, as well as find cost savings, labor productivity, or enhanced revenue streams

- Emergence of hyperscalers as application providers: Hyperscalers are leveraging their AI expertise to offer best-in-class application solutions, such as BI, virtual assistants, IDP and CX. This is increasing the supply of AI applications solutions and thus (theoretically) should eventually lower AI cost barriers.

- Productization/commoditization: AI features are increasingly being incorporated into common business software tools (e.g., Microsoft Outlook, Zoom, Adobe Photoshop), but the AI technology is working in the background. I call this ‘invisible AI’ as the user is often unaware AI is driving a specific feature, yet AI’s reach is expanding deeper into the market.

Given the buzz surrounding AI over the past several years, one might conclude that it is now a mature market. While that might be true for a few consumer applications, the enterprise market for AI software might still be crawling.

According to survey data from Omdia’s AI Readiness Barometer (3Q21), even in North America – one of the most mature AI geographies – only 16% of business end users have an AI strategy in place.

Omdia estimates that in 2020, non-consumer AI software revenue accounted for less than 5% of total enterprise applications software spend (including enterprise applications, security, IT infrastructure and analytics). It will increase its share to just 6% in 2021. AI enterprise opportunity is wide.

Caution: Speed bump ahead!

The market path is not entirely smooth sailing for AI. Some headwinds include:

- Data challenges: Enterprise end users are finding organizational impediments to integrating data and governing it.

- Trustworthiness: Accountability, transparency, ethics, and security are issues as end users question AI’s ability to operate without bias and to maintain data securely. Also, employees fear AI will replace their jobs.

- Talent shortage: Data scientists and other knowledge workers with AI expertise are in short supply.

- Regulation and policy issues: Restrictive regulations and mandates on personal information could restrain adoption. Internationally, reshoring, nearshoring, data sovereignty, and lack of cross-border data-sharing frameworks can hinder AI investments.

Demand for AI software is following a typical S-curve growth trajectory typically seen in new technology markets.

As AI features are increasingly added to common software and replace portions of the legacy software market (think Ms. Pac-Man), AI market growth initially mushrooms.

As AI’s share of the market widens, the growth rate begins to decelerate.

Omdia conservatively is expecting the annual growth rate decline that started in 2019 to return in 2022, although growth rates will still exceed 20% for most forecast years.

As the market evolves toward the end of the forecast horizon in 2027, AI should quickly soften into a mature market pattern of growth.

Neil Dunay is a principal market forecaster at Omdia, forecasting on enterprise technology, particularly for AI and other emerging technologies.

His focus is on leveraging statistical tools to discover interrelationships among technological, economic, demographic and sales trends that drive market evolution.

Written by AI Business and republished with permission.